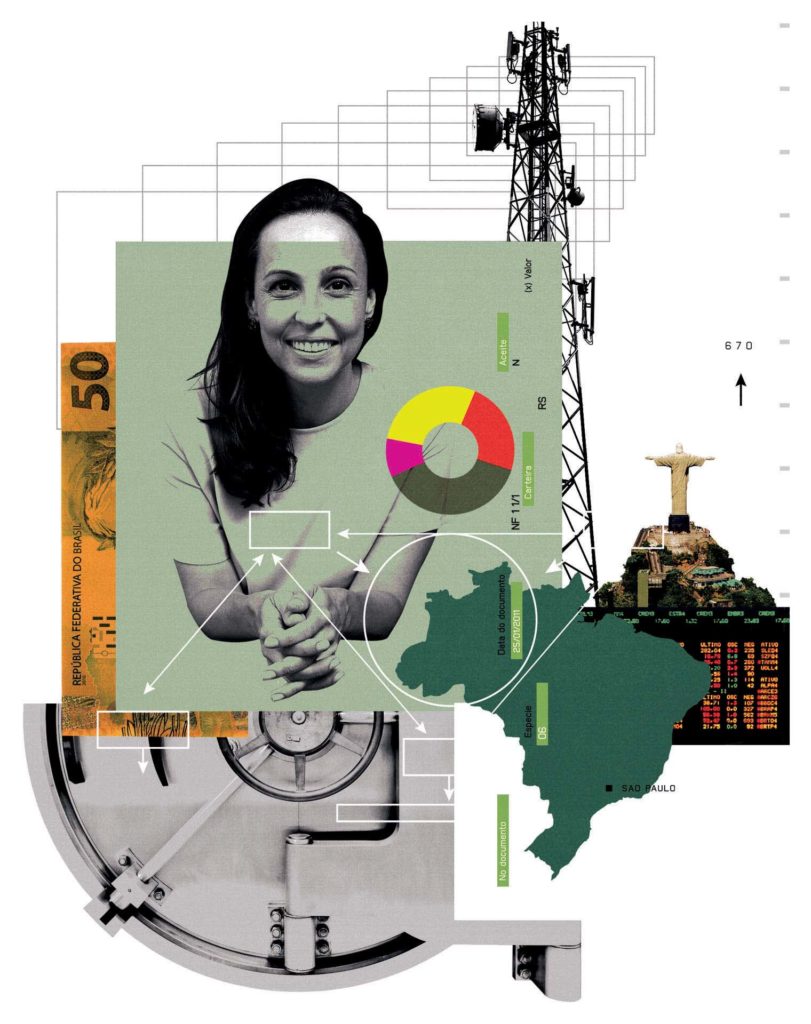

Luciana Dias: Shaking up Brazil’s Securities Laws

In Brazil, the government has long been among the most influential, if unaccountable, members of the corporate establishment. In recent years, that has begun to change, thanks in part to Luciana Dias, JSM ’05.

In 2015, with Dias taking the lead, the CVM, the Securities and Exchange Commission of Brazil, voted to punish the federal government, as the controlling shareholder of Latin America’s largest utility, Eletrobras. The government had used its voting power to force the company to cut its rates, as part of an inflation-fighting deal with the administration of then-President Dilma Rousseff, which led to huge losses for stockholders. While Eletrobras argued it could do whatever it wanted, Dias persuaded her fellow commissioners that the government had a conflict of interest and should be fined for participating in the rate-cutting decision.

“It was a courageous vote and an important moment,” recalls Marta Viegas, a specialist in corporate governance for IDB Invest, the Inter-American Development Bank’s private sector investment arm in Washington. The unprecedented ruling portended new rights for minority shareholders of state-owned companies in Brazil.

Dias, now a partner in her São Paulo-based firm L|Dias Advogados, has been in the vanguard as Brazil has tackled legal and cultural barriers in an effort to modernize its corporate law and capital markets.

Over the course of an eight year career at the securities agency where she served as a top official and then a commissioner, she helped to reshape the regulatory landscape for Brazilian companies looking to sell stock to the public—from rewriting the rules covering the disclosure obligations of public companies to challenging the working assumptions of managers of the nation’s powerful state-owned enterprises.

“Luciana was part of this up-and-coming, younger generation of regulators and policymakers. With a U.S. legal education and a global business mindset, she was very sophisticated and quite influential in strengthening and developing Brazil’s capital market.”

– Eugenio Cárdenas, JSM ’10, JSD ’14, Lawyer, Kirkland & Ellis LLP

“She has what we call the ‘espírito público,’ ” says Maria Helena Santana, a former chair of the CVM who gave Dias her first job at the agency. “She was very serious, very committed, very deep in her analysis of all the problems and complex issues that would come to her and very brave in the difficult decisions she had to take.”

That spirit was informed at SLS. A first-generation Brazilian born to Portuguese parents, Dias earned degrees in law in her hometown of São Paulo before coming to Stanford, where she earned a Master of the Science of Law in the Stanford Program in International Legal Studies.

Dias says she found the environment unusually supportive and stimulating, an opportunity to meet and learn from students from around the world. With an interest in public service, the experience was also a springboard to her chosen career.

“I learned to look at law as a tool of public policy,” she says. She wrote a thesis analyzing weaknesses in corporate governance in the Brazilian state pension system. After graduating, she spent a year at a New York law firm, working on mergers and other deals, and then it was back to Brazil to put some of that theory into practice.

Stock markets in Brazil have been historically underdeveloped, with major industries controlled by families or the government. The inability to attract outside capital also put limits on the country’s ability to grow. Around the turn of the century, such concerns gave way to a series of legal and institutional reforms.

The São Paulo Stock Exchange launched a new listing segment called the Novo Mercado (New Market) that made it cheaper for companies that adopted pro-shareholder bylaws to raise capital.

The CVM, which had been tightly controlled by the government, was given some regulatory and budgetary autonomy and commissioners were given fixed terms and protections against arbitrary dismissal. In 2007, Dias became part of the dynamic new era when she was appointed to the CVM’s top rule-making job.

“It was a time when Brazil’s financial system was undergoing a shift toward higher regulatory intensity and enforcement,” says Eugenio Cárdenas, JSM ’10, JSD ’14, a capital markets lawyer in the Houston office of Kirkland & Ellis LLP. “Luciana was part of this up-and-coming, younger generation of regulators and policymakers across emerging securities markets. With a U.S. legal education and a global business mindset, she was very sophisticated and quite influential in strengthening and developing Brazil’s capital market.”

One of her main jobs included fixing the disclosure system for publicly traded companies—the basic source of information for investors and regulators. The rules were dated, and the technology was ancient.

Dias led efforts that involved surveying U.S. and European disclosure standards and negotiating and balancing the interests of a wide range of stakeholders to come up with a meaningful and acceptable solution.

Under the new regime, Brazilian disclosure obligations, for the first time, focused on policies of the issuers, such as governance practices, and why those policies and internal rules made sense. A new standard form was required to be updated annually, or whenever a company was selling stock to the public.

“We had a system that was completely useless,” says Guilherme Sampaio Monteiro, LLM ’10, a partner at one of Brazil’s largest law firms. “She brought experience and knowledge and helped create a new and sophisticated international standard.”

As a CVM commissioner from January 2011 through December 2015, Dias developed a reputation for professionalism and independence, no small achievement in an emerging market where the government and powerful families are used to calling the shots.

In the U.S., activist investors and large institutional shareholders often act as a check on management. “That picture is less prevalent in Brazil and the rest of the world,” explains Evan Epstein, LLM ’05, former executive director of the Rock Center for Corporate Governance.

“If you are a regulator in Brazil, you have to look out for that kind of transaction—typically involving how to protect the minority investors from the majority or control shareholders,” says Epstein, a corporate lawyer from Chile, who got to know Dias when both were international students at the law school.

As a commissioner, in 2014, Dias challenged a proposed merger of the largest telecom companies in Brazil and Portugal. Questions had arisen about how the Portuguese were valuing assets in the exchange and whether it was fair to the Brazilian investors. When the controlling shareholders of the companies were able to push through the deal, the minority shareholders complained to the CVM.

Dias argued that there were enough unanswered questions that the merger should be decided by the minority shareholders. But the full commission decided to dismiss the complaint and allow the deal to proceed. Just 18 months later, the newly merged company became the largest in the history of Latin America to seek bankruptcy law protection. Dias seemed prophetic.

Her position in the Eletrobras case also suffered blowback when an appeals body reversed the CVM decision to fine the company. But the controversy—and a separate corruption scandal involving the state oil company Petrobras that continues to reverberate at the highest levels of government—sparked a public debate about the management of state-owned enterprises that led to the adoption of a new federal governance law.

“It was the beginning of a very healthy improvement in the Brazilian regulation,” Dias says, “which is still not perfect, but we don’t see ministers and other high-level public employees sitting on boards of state-owned companies. Most of the companies are much more independent from the government.”

Today, through her own firm, she offers expert advice on corporate and securities market issues and arbitrates investor disputes. She sits on the audit committee of the stock exchange and is a member of the board of the Brazilian national development bank. She teaches law. And she is married with two young children.

“Luciana carries with her a ton of experience from all these different worlds, which makes her unique. And she has a work ethic that is second to none,” says John Anderson, a partner in the São Paulo office of White & Case, who has known Dias since law school in Brazil. “I see nothing but success for her.”

Rick Schmitt, an attorney and freelance writer, was a staff writer and editor for The Wall Street Journal and the Justice Department correspondent in the Washington Bureau of the Los Angeles Times.