Analytics Expanded: Lex Machina Extends Platform to Securities Law

Summary

Once a buzzword, analytics is changing the way law firms and legal departments process and act on information. After making strides by providing analytics for IP law, LexisNexis company Lex Machina plans to take its platform to all areas of federal practice, the first step of which will be into securities law.

Beginning July 21, the technology allows security litigators to develop their legal strategies using information from federal securities cases to find information on law firms, lawyers, judges and venues. Titled “Legal Analytics for Securities Litigation,” the platform contains data from over 14,000 securities litigation cases that go as far back as 2009. Among them are private actions; shareholder derivative suits; securities fraud class actions; and SEC enforcement cases.

…

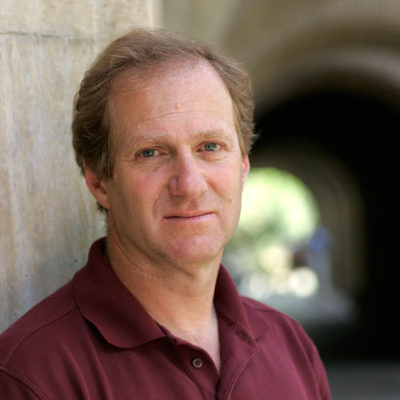

Also applying analytics in securities litigation is Stanford Law School’s Securities Litigation Analytics project. Founder Michael Klausner noted that using data analytics, lawyers can “predict the likelihood that a case will be dismissed” as well as “measure the risk entailed in waiting for a ruling on dismissal before trying to settle.”

He added that “while the past predicts the future very imperfectly,” having data from years of past cases “can be valuable in litigating a case today.”

Read More