Dell Faces mutiny, Stigma of Management Buyouts

Summary

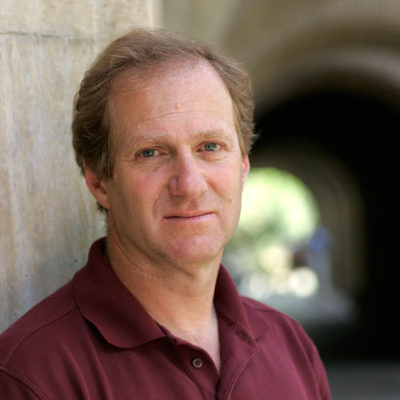

Professor Michael Klausner spoke with MarketWatch's Benjamin Pimentel on the uncertainty that Dell's Ceo and investors face “in their ability to close the $24 billion deal” and what makes this deal so “tricky and unusual.”

Dell Inc.'s bold plan to go private is facing some pretty serious pushback, and some experts believe a proxy battle with shareholders is now a distinct possibility.

However, several analysts covering Dell (US:DELL) believe the deal will go through — at or near the current price of $13.65 per share. While the PC maker's stock is now trading at a small premium to the offer price, there is some doubt that opposition from two of the company's largest institutional holders will lead to a higher offer.

…

Michael Klausner, who teaches business law and corporate governance issues at Stanford Law School, said it is both tricky and unusual in Dell’s case, given the huge stake of founder and CEO Michael Dell, who is “putting in a lot of money, which means he thinks it’s a good deal.”

Klausner added, however that “I suppose on the other side, they're saying, 'Wait a minute, he knows something we don't know.'”