Here’s What C.E.O.s Are Thankful For

Summary

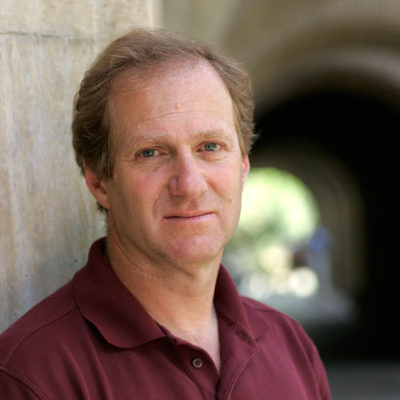

A pending lawsuit over Michael Klein’s $11 billion SPAC deal with the health services company MultiPlan highlights a big issue with the governance of blank-check firms, Michael Klausner of Stanford Law School and Michael Ohlrogge of N.Y.U.’s law school write in a new paper.

The proposed solution: SPACs should pay and structure their boards differently, Klausner and Ohlrogge argue. Sponsors can appoint truly independent directors by, for example, hiring a recruiting firm. And they can pay these directors with regular shares or cash, as most companies do. These practices won’t address all of SPACs’ perceived problems, but it’s a place to start.

Read More