Liability Concerns Impede Director Recruitment At Banks

Summary

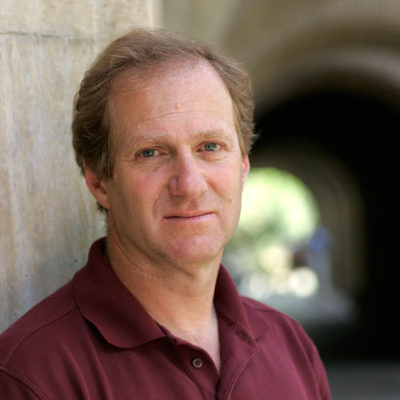

American Banker quotes Professor Michael Klausner on the rising risks of personal costs to bank executives from 2008 onward.

Want to spook out a local business leader? Ask him or her to serve on a bank board.

A rise in the number of lawsuits filed against bank directors has stoked fears that board members could be forced to pay out-of-pocket costs if a bank messes up, particularly when a bank fails.

The Federal Deposit Insurance Corp. has filed at least 90 lawsuits against directors or executives of banks that have failed since the financial crisis in hopes of recouping losses to the agency’s insurance fund.

…

It is clear that, before the financial crisis, out-of-pocket legal costs for directors were very rare. From 1981 to 2006, there were just 13 instances among all U.S. corporations when a director paid directly to settle costs or legal damages, according to a paper by Stanford University law professor Michael Klausner. The risk of personal liability “is very low, far lower than many commentators and board members believe,” the paper concluded.