Opinion: The SPACsplosion is about to become a liquidation frenzy — and that may be for the best

Summary

For those who are still invested in a SPAC, liquidation may ultimately be the best outcome among many poor paths, experts said.

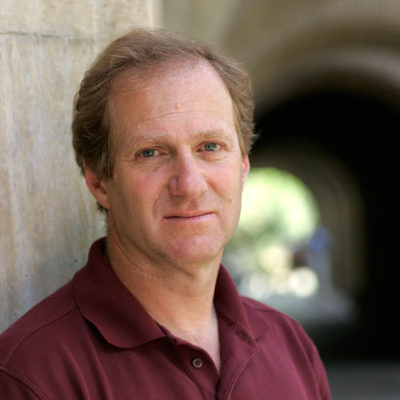

“It’s a noble thing to do,” said Stanford University professor Michael Klausner, who has been studying SPACs for the past couple of years. “It would be far worse to enter into a bad deal, which is what most SPACs have done.”

There are nearly twice as many SPACs still seeking a target or facing possible liquidation. There are 590 publicly traded SPACs facing a deadline to find an acquisition target within the next two years, according to SPAC Research data.

“SPACs from the start have been a terrible structure for investors,” said Klausner, who has co-authored several papers and articles on SPACs, including “A Sober Look at SPACs.” “And what’s happening now is 100% predictable, was predicted — we predicted it. The mystery is why it took so long for the market to figure it out.”

Essentially, the biggest winners in the SPAC boom were the initial IPO investors, those who invested when a SPAC first went public, and sold when the stock reached a high during the crazy mania of 2021, many of which were hedge funds.

“So the IPO stage is just a gravy train for hedge funds that participate in it,” said Stanford’s Klausner. Those hedge funds that dominated the SPAC market were often called the “SPAC Mafia.” None of those early investors hold the shares through the time of the merger, he said. “The ones that come in on the secondary market after the IPO, those are the ones that get screwed. The IPO investors are gone. … I cannot understand why anyone would remain invested in a SPAC.”