SPACs are sputtering in 2022, leaving retail investors holding the bag for a Wall Street innovation that just hasn’t panned out

Summary

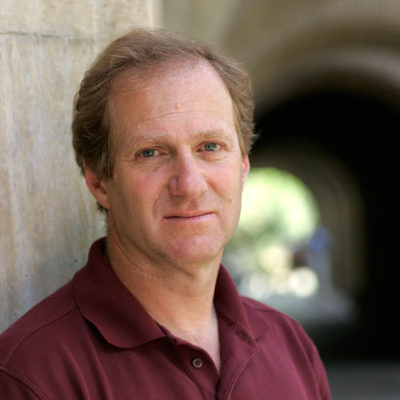

Michael Klausner, a professor of business and law at Stanford University who authored the paper “A Sober Look at SPACs,” says the investment vehicles actually end up costing companies more than traditional IPOs and often hurt retail investors.

“SPACs are a pile of money that the banks can’t resist,” Klausner told Bloomberg last year. Excessive fees mean SPACs are “a really good deal for the banks,” but “a really bad deal for the shareholders.”

Read More