Tesla Quietly Changed Its Bylaws To Ward Off SolarCity Shareholder Fight

Summary

Tesla’s offer to buy SolarCity ( SCTY 0.46% ) sparked a barrage of criticism on Wednesday over the glaring conflict of interest between the two companies: Elon Musk, the CEO of Tesla ( TSLA -0.16% ) , is also the chairman of SolarCity and the largest shareholder of both companies, owning more than 20% of each.

Critics panned the deal as everything from a “corporate governmental mess” to “the corporate form of a West Virginia wedding.” Between Musk’s personal financial interests in each company and the overlap between Tesla and SolarCity’s boards—with few directors who aren’t either related to Musk by blood or have ties to both companies—investors weren’t sure whether the acquisition was really in their best interest. Tesla’s stock price fell more than 10% during the day. “We expect a robust shareholder fight over this acquisition centered on corporate governance,” Oppenheimer analyst Colin Rusch wrote in a research note as he downgraded Tesla stock to neutral.

…

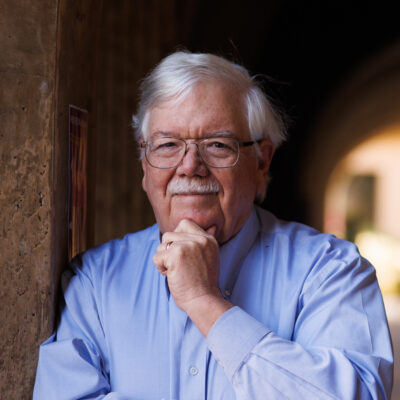

“There is a very high probability of litigation if the Tesla-Solar City deal becomes real. It’s a virtual certainty,” says Joe Grundfest, a professor at Stanford Law School and its Rock Center on Corporate Governance.

Read More