The Theranos Scandal Could Become A Legal Nightmare

Summary

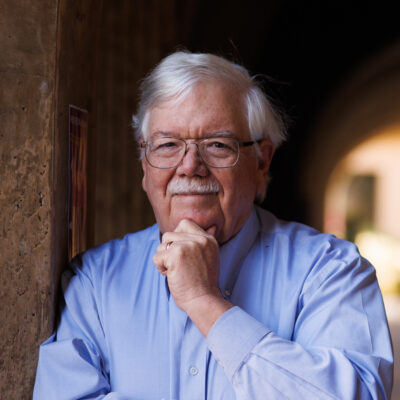

Wired quotes Professor Hank Greely on whether or not Theranos, a blood testing company, would be able to pursue a libel suit against the Wall Street Journal after a controversial article.

Two weeks ago, Theranos was a blood-testing company frequently associated with adjectives like “innovative” and nouns like “unicorn.” On October 16, the Wall Street Journal published a nearly 3,000-word story about the company that said it didn’t deserve either descriptor. In short, the story said that the company’s claims about its transformative diagnostic technology—painless tests, with faster results, that are comparable to the industry standard—were false.

A week later, Theranos pushed back against the Journal, attacking the paper’s reporting, reputation, and even its motivations for writing the piece.

…

He’s right. You can always sue. “The question is whether you can win,” says Hank Greely, a lawyer at Stanford Law School who specializes in biology and medicine. “They’d have to show that the Journal acted recklessly or with malice.” In other words, they don’t just have to prove that the newspaper is wrong, they have to prove that the newspaper knew it was wrong.

…

“In individual cases you might be able to show that a test was inaccurate and led to you getting an intervention or procedure didn’t need,” Greely says. But this is rare. “You have to show how you were damaged.” More likely, he says, would be a class action lawsuit, where attorneys would seek to recoup financial damages to the thousands of customers who have paid $10 to $200 for individual tests.

…

The least likely possibility, say the lawyers we talked to, is that investors might sue. Only the most extreme scenario—that Theranos has been a fraud, a con-job, from day one—would spark that, says Greely. From the start, Theranos has had investments from hugely influential venture capitalists—including ATA Ventures, Draper Fisher Jurvetson, and the Lawrence J. Ellison Revocable Trust. A lawsuit from any one of them would undermine the company, like getting a vote of no-confidence. “If a major investor sues for fraud, it will pretty much kill the company off,” Greely says. Say goodbye to any return on investment.

Read More