Jason Hegland

- Co-founder and Executive Director, Stanford Securities Litigation Analytics

- Room 40, Crown Quadrangle

Stanford Securities Litigation Analytics (SSLA)

In association with ongoing research, the Stanford Securities Litigation Analytics (SSLA) project tracks and collects data on securities class action litigation and SEC enforcement actions brought to enforce the disclosure requirements of the securities laws.

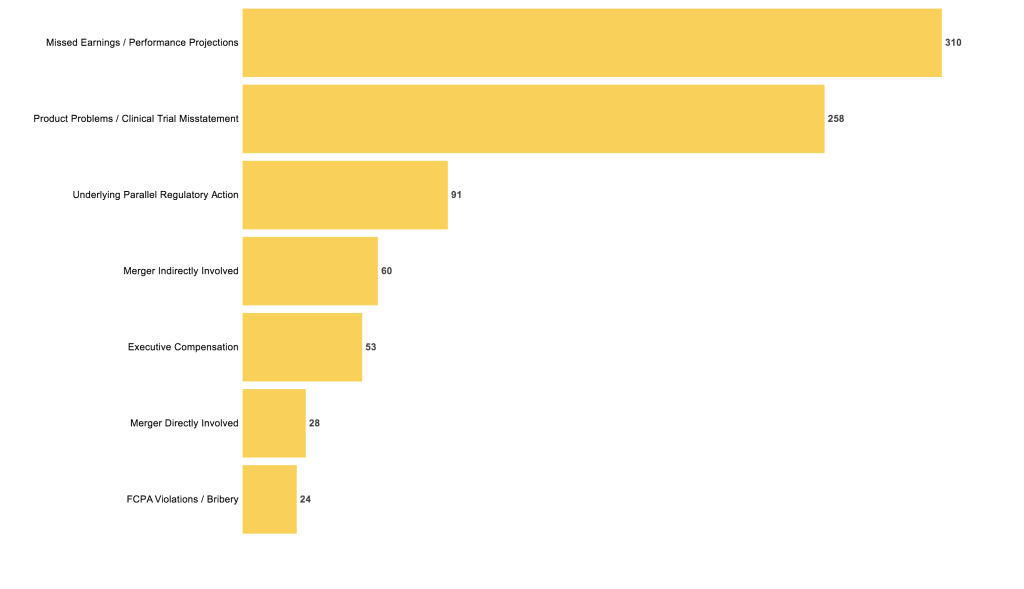

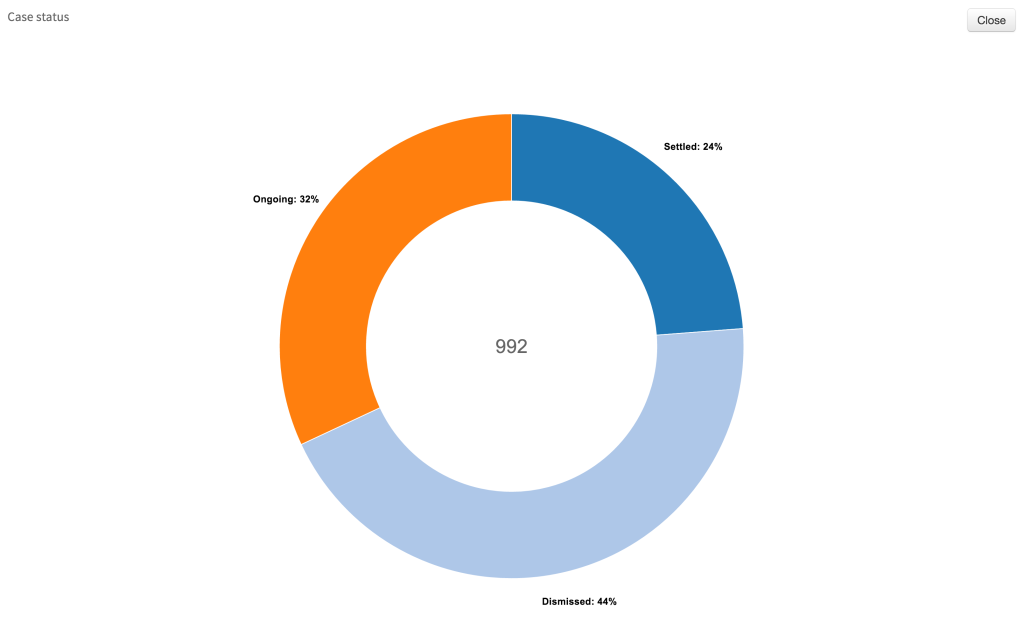

These cases allege material misstatements or omissions of material information that adversely affect the valuation of a company’s securities. Full-time SSLA analysts gather nearly 1,000 data points for each case through sophisticated machine and human searches of various sources, including press releases, court filings, company financial statements, SEC enforcement releases, and interviews of lawyers involved in the cases. In the future we plan to databases of shareholder derivative suits, state court securities class actions and criminal enforcement actions.

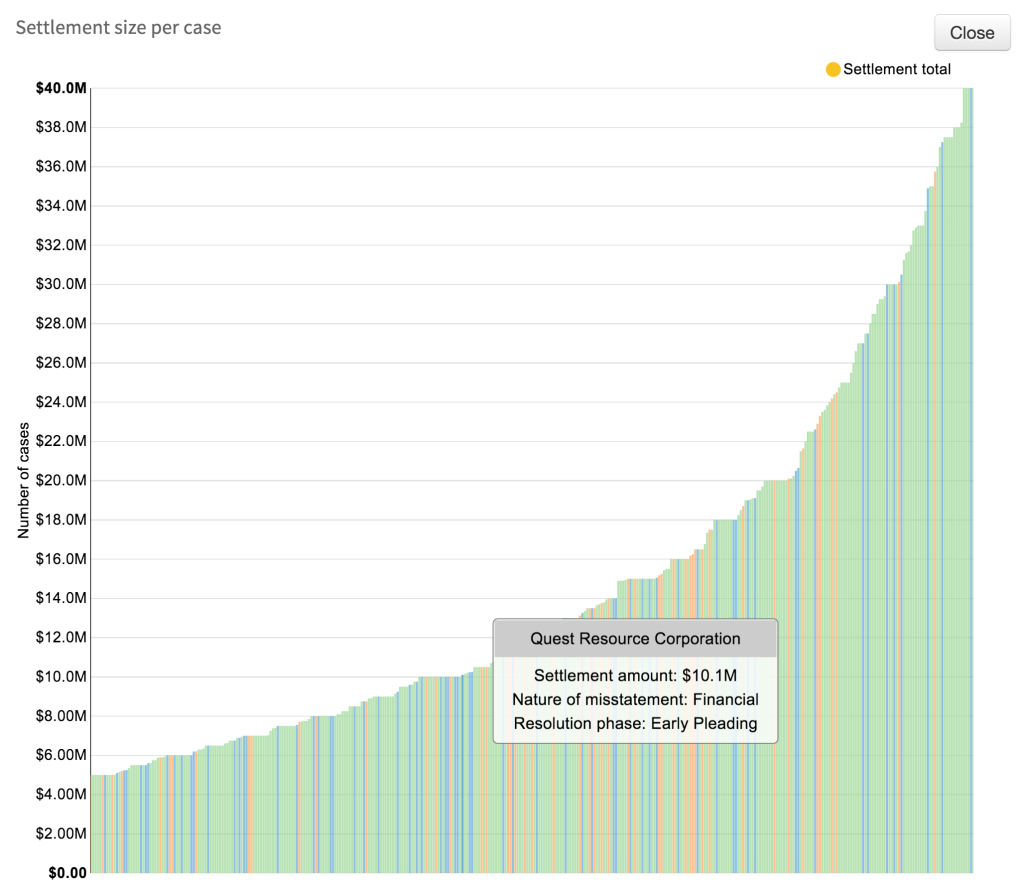

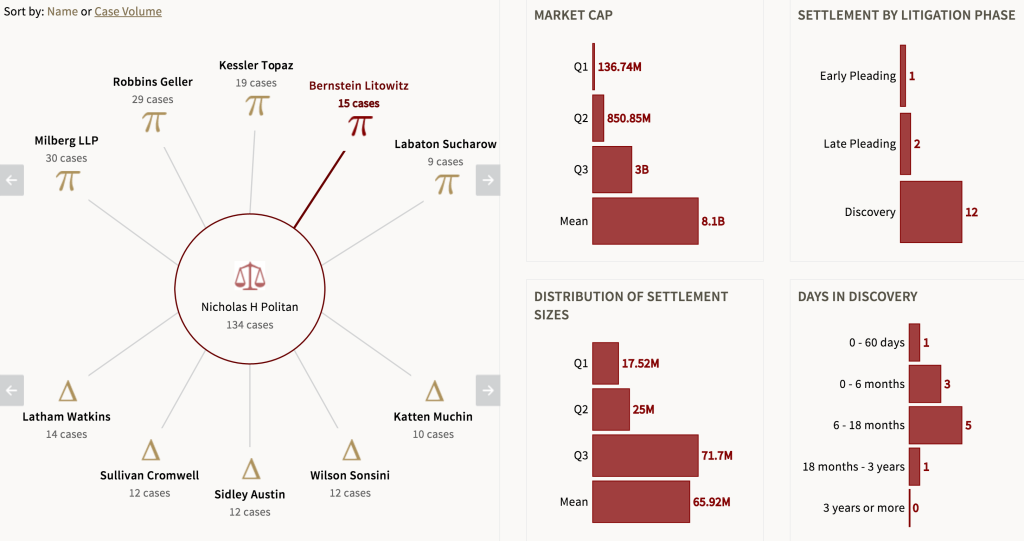

SSLA recently launched an updated website that allows licensed users to query the SSLA class action database across over 40 filters. Results of queries are displayed through interactive visualizations and downloadable results tables.

Examples of the type of data we collect and filters users can search by include:

- Names of parties

- Judges

- Attorneys

- Nature of allegations

- Measures of the strength of a case

- Company industry, market cap and alleged shareholder losses

- Key litigation events and dates

- Real time case status

- Settlement timing

- Settlement amounts

- Contributions by defendants

- Contributions by D&O insurers

- Attorneys’ fees and expenses

- External factors that could affect case outcomes, such as presence of parallel enforcement actions and bankruptcy

SSLA is thus able to generate and manage a thorough and accurate database of securities litigation with the capability of detailed queries and in-depth analytics. To help fund our research, SSLA licenses the underlying raw data and accessed to the web tool to D&O insurers, brokers, law firms and institutional investors. If our data can help you in your business, or if you would like to help us in this next phase of development, please let us know!