Lawsuit Testing Value of SPACs Survives Motion to Dismiss

Summary

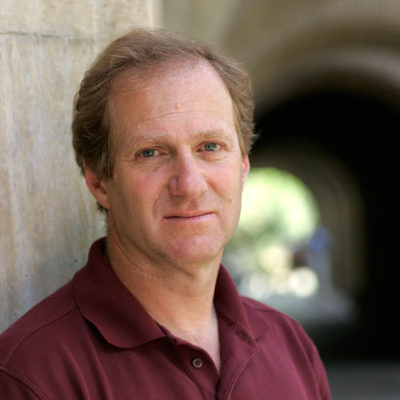

Stanford Law Professor Michael Klausner developed a financial model that argues the true value of SPAC shares are much lower than $10-a-share. He brought the court case in August 2021 against GigCapital3 alongside lawyers from Grant & Eisenhofer. The suit was a rare move for a self-described “obscure academic.”

In the Gig3 case, the sponsor’s initial $25,000 investment had an implied market value at the time of the merger worth $39 million—a 155,900% return, Klausner argued. Sponsors only earn those returns when a deal is completed.

Will’s ruling accepted Klausner’s calculations.

Klausner said the case is the first to recognize that “the basic structure of SPACs” dilutes the value of shares.

The effect of the ruling, he said, is that SPACs should disclose the amount of cash they hold per share. The U.S. Securities and Exchanges Commission noted Klausner’s research on dilution in its rules proposal last year, which has already been part of a severe decline in the number of new SPACs.

“Hopefully, the SEC will see what Vice Chancellor Will saw in the SPAC structure,” Klausner said.

Read More