SPAC Math No Longer Adds Up

Summary

The argument above is loosely based on a well-known 2020 paper called “A Sober Look at SPACs,” by Michael Klausner, Michael Ohlrogge and Emily Ruan.

Intuitively, if the “net cash per share” — that is, the money that the SPAC has in its pot, divided by the real number of shares including free sponsor shares and warrants — is $5.70, then either target companies are getting a bad deal (giving up $10 of value for $5.70 of cash), or public SPAC shareholders are getting a bad deal (getting $5.70 of value for $10 of cash). And Klausner et al. find that it’s mostly the shareholders getting the bad deal. Their article “concludes by suggesting that the SEC promulgate disclosure requirements specific to SPAC mergers that make clear SPACs’ costs and sponsors’ incentives.”

But that’s just an academic paper. Putting his money where his mouth is, though, Klausner went out to sue some SPACs, and last week he won a round.

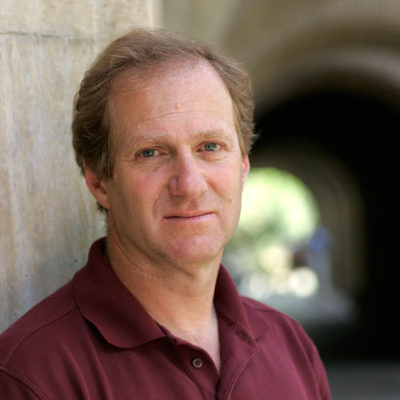

Stanford Law Professor Michael Klausner developed a financial model that argues the true value of SPAC shares are much lower than $10-a-share. He brought the court case in August 2021 against GigCapital3 alongside lawyers from Grant & Eisenhofer. The suit was a rare move for a self-described “obscure academic.”

In the Gig3 case, the sponsor’s initial $25,000 investment had an implied market value at the time of the merger worth $39 million—a 155,900% return, Klausner argued. Sponsors only earn those returns when a deal is completed.

Will’s ruling accepted Klausner’s calculations. Part of the information GigCapital3 shareholders didn’t receive was that the shares the SPAC used to purchase Lightning eMotors were worth around $5.25 per share—not $10, according to Will.

Read More