Trump’s Big Social Media Deal Could Soon Collapse. So What Went Wrong?

Summary

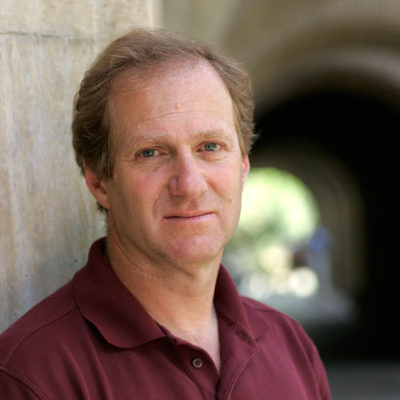

Michael Klausner, an economist and lawyer at Stanford, says the SEC has a lot of legitimate concerns about SPACs that have nothing to do with partisan politics.

“The mystery to me, and I think to others, is how on earth they lasted so long,” says Klausner. “It’s really unbelievable.”

Klausner recently filed lawsuits against the sponsors of several SPACs, accusing them of hiding from regular investors the details of how much money they would ultimately walk away with—according to Klausner, as much as 50 percent of the money invested before a merger can get hoovered up by SPAC sponsors and other insiders.

“From the beginning, a SPAC was a very bad investment for a non-redeeming investor,” he says, referring to investors who buy into a SPAC and hold on to their shares until after a merger.

“The problem they find themselves in, is they made themselves into a meme stock with retail investors, who are now legitimately unhappy,” he says. “But the SEC, to me, doesn’t seem to be the place to direct their unhappiness.”

Read More