Legal Matters: Arthur Rock on the Early Venture Capital Decisions That Sparked Decades of Innovation

The VC who helped to launch Fairchild Semiconductors, Intel, and Apple discusses his career with Professor Joseph Grundfest.

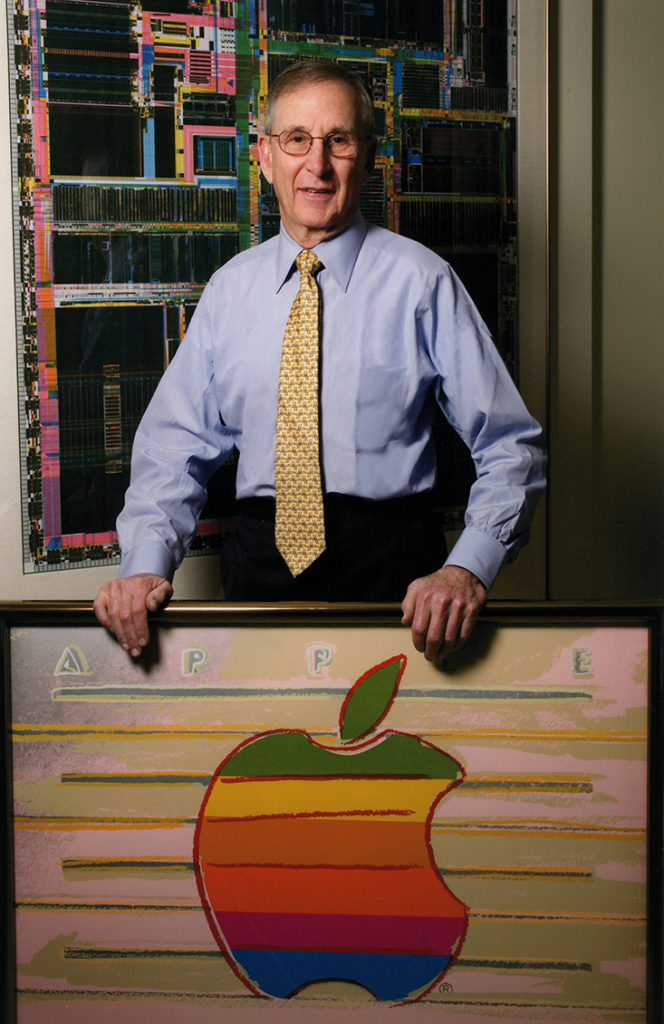

Arthur Rock, one of the most influential and successful venture capitalists, understands the value of luck. The trick, he explains, is being lucky early in life, recognizing good luck when it comes your way, and knowing how to capitalize on it.

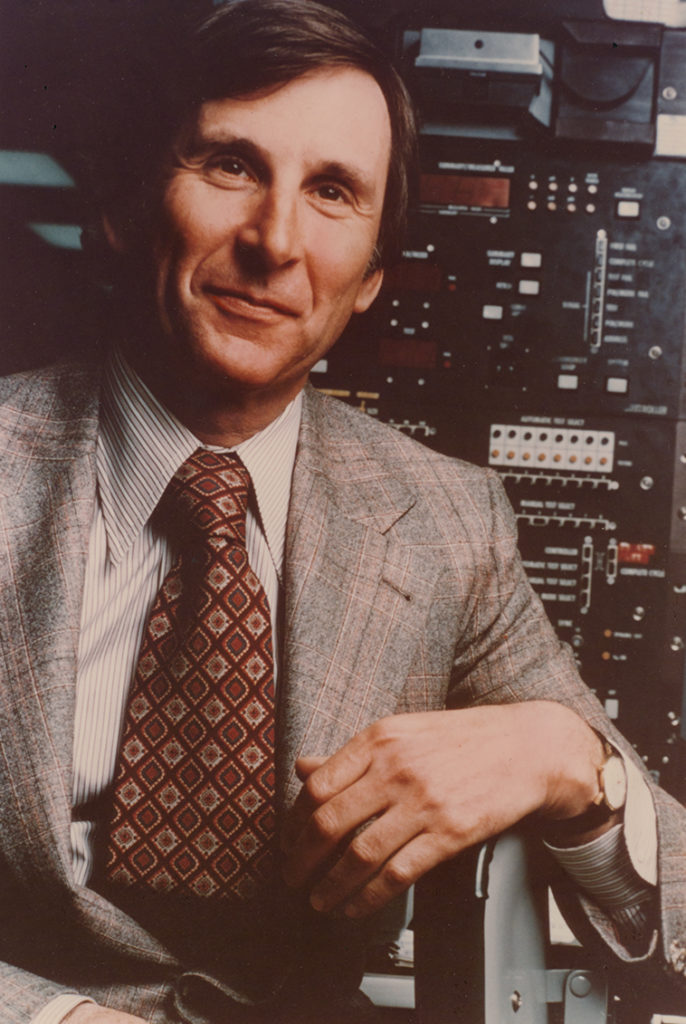

The stars certainly aligned when, in 1957, Rock was a young MBA working at the New York investment firm Hayden Stone. There, a client was the father of a scientist working at the Shockley Lab of Beckman Instruments. The client wrote to his Hayden Stone broker to ask if he could help his son and seven colleagues leave their current jobs to find another company that would appreciate their scientific accomplishments and help further the new technology of semiconductor design and manufacture.

“Lucky for me, this broker showed me the letter. I talked to these scientists, and it was decided that one of the partners at the firm and I would come out to San Francisco to meet them,” Rock said in an earlier essay. Those scientists were encouraged by Rock to ditch the notion of working for another corporation and instead to start their own. They became famous as “the traitorous eight,” and their “startup,” Fairchild Semiconductor, launched multiple spinoffs—and arguably established Silicon Valley as the innovation center of gravity for the world.

While the stars aligned for Rock early by putting him in the right place at the right time, it was his ability to recognize an opportunity before anyone else—and to suggest a new way of doing business—that put him in the history books.

After the Fairchild deal, Rock moved to California in 1961 and established one of the first venture capital firms, Davis and Rock, which helped launch Scientific Data Systems. He then branched out on his own to form Arthur Rock and Associates, and the rest is history.

Rock is widely considered to have coined the term “venture capitalist” to describe his work, and his contributions to American (and worldwide) innovation from the late 1950s to today is nothing short of legend. He institutionalized the now common practice of broadly sharing stock options with all employees. He made the practice of four-year vesting with a one-year cliff the new normal. He adopted responsible governance practices designed to promote integrity and transparency, and that would help brilliant technologists get the business advice they needed for success. And rather than investing in and then watching a startup sink or swim on its own, he rolled up his sleeves and

took an active role, investing both time and money to help coach company founders, many of them scientists without business experience, to succeed and grow.

Along the way, Rock’s investments and personal guidance helped launch and govern a distinguished roster of corporate firms including Intel, Apple, Scientific Data Systems, Teledyne, Xerox, Argonaut Insurance, AirTouch, the Nasdaq Stock Market, and Echelon Corporation.

These days, Rock and his wife, Toni Rembe, are focused on investments of another kind—the future of underserved communities in the United States through their support of educational opportunities. He was co-founder and is president emeritus of The Basic Fund, which provides scholarships for inner-city children to attend K-8 private schools. He served on the board of Teach for America and Children’s Scholarship Fund and is an active funder of the KIPP network of public charter schools—as well as about 100 other K-12 schools.

He founded the Arthur Rock Center for Entrepreneurship at Harvard Business School and together with his wife founded the Arthur & Toni Rembe Rock Center for Corporate Governance at Stanford University. And he is the recipient of many honors including the 1987 EY Entrepreneur of the Year Award and the 1989 Golden Plate Award of the American Academy of Achievement.

Here, Rock discusses his career in venture capital with Joe Grundfest, JD ’78, W. A. Franke Professor of Law and Business, emeritus, at Stanford Law School and a senior faculty member of the Rock Center. A former commissioner of the Securities and Exchange Commission, Grundfest is a successful entrepreneur in his own right who founded Financial Engines, which he helped grow through an initial public offering and subsequent sale to a private equity investor.

JOE GRUNDFEST: Arthur, let’s begin with Silicon Valley’s genesis story and your role in forming Intel, where you were central not only to the company’s founding but, much more significantly, to establishing a model for how venture capital could help nurture startup companies, a model that included a company’s financing compensation arrangements and its governance mechanisms.

ARTHUR ROCK: Well, I expect you’re interested in the options we gave employees.

GRUNDFEST: Absolutely. I suspect few people know of the elegant four-page document you drafted that describes the terms of the convertible note you used to fund Intel and explains the Intel philosophy for employee compensation and operational governance. From my perspective, your Intel memo is the Magna Carta of the venture capital industry. That memo is the first major financing organizational document from which everything else flows. Virtually every other subsequent venture capital deal in Silicon Valley follows a structure that traces back to that Intel structure. Can you tell us why you structured the Intel investment as you did?

ROCK: Well, Gordon [Moore] and Bob [Noyce] and I were sitting in one of their offices and trying to figure out how we could motivate our employees. We knew that we were paying less than what these employees could make elsewhere but that they wanted to be with us at Intel. We didn’t think that was quite fair [to underpay them]. And we really, among the three of us, decided that the employees should get options. But at what price and when did they get them? We kicked that around quite a bit and finally decided that we would give options to employees who had been there at least a year and that they would be at a price that could make them some money.

read the Intel Convertible Note by Arthur Rock

GRUNDFEST: So basically, Intel’s major innovation in 1968 wasn’t only that it built the world’s first commercially successful microprocessor, but that it introduced a new compensation model for its employees that wound up being the model for the rest of Silicon Valley. That’s the one-year cliff with the four-year vest.

ROCK: Right.

GRUNDFEST: And it built a team culture that invested all employees in the company’s success.

ROCK: Correct.

GRUNDFEST: And after Intel introduced options, it became common practice in Silicon Valley—options for everybody with that one-year cliff and a four-year vest period. That basically was your invention.

ROCK: That’s correct.

GRUNDFEST: And the strike price for the options would be on the common, so lower than the strike price for the preferred, which would give employees a strong incentive with a lot of upside for their efforts.

ROCK: That’s right, and then eventually companies got so big that you couldn’t really do that. You had employees who really would not benefit, wouldn’t earn their options. So that disappeared after about, I don’t know, five or 10 years.

GRUNDFEST: But early on, that was a key part of the structural motivation.

ROCK: Absolutely.

GRUNDFEST: And when you were pulling this deal together and combining novel compensation arrangements with the preferred/common structure, and the novel governance structure, was there any self-awareness that you were constructing a model that would define the future of Silicon Valley?

ROCK: No, not in the least. I just thought of it as something that would work here.

GRUNDFEST: And it worked so well that everyone copied it.

ROCK: That’s correct.

GRUNDFEST: And I have to say, I don’t think that there is any other single document in the history of venture capital that’s as prescient and formative as these four pages that lay out a model of how you do venture capital investment.

ROCK: Yes. First, the lawyers got into it, and I said, “The hell with that.”

GRUNDFEST: But the document is elegantly written, and it’s my understanding that you wrote it yourself.

ROCK: I wrote it myself.

GRUNDFEST: And you gave it to the lawyers and you told them to make this happen.

ROCK: I don’t think I needed to tell them that when they read it.

GRUNDFEST: Now, one of the other fascinating aspects of your approach to venture capital, of your relationship with Intel, and of so many of the other deals that you’ve done is this concept of “intellectual book value.” Sebastian Mallaby’s history of Silicon Valley, The Power Law, frequently cites you and repeatedly refers to your concept of intellectual book value as central to your investment philosophy. Arthur, what is intellectual book value?

ROCK: Well, we know what book value is.

GRUNDFEST: Yes. Well, sometimes we do, yes.

ROCK: Mallaby wanted me to articulate what else enters the mix for a successful venture, and I said, well, what you want is intellectual book value.

GRUNDFEST: How do you calculate intellectual book value?

ROCK: Intellectual book value is the difference between what the marketplace is on a company and what the actual market is. It can be whatever anyone wants to read into it, but for me it’s the value that you put on what people produce that isn’t in dollars.

GRUNDFEST: So, it encompasses skills like leadership and motivation.

ROCK: Right, exactly.

GRUNDFEST: Intelligence, integrity, and all of the human factors that are essential for success.

ROCK: Human value is the correct definition.

GRUNDFEST: So, it’s what people bring to the table that accountants and the financial analysts miss.

ROCK: Well, they don’t miss it. It’s not in their book. They’re not asked to look for it.

GRUNDFEST: Right. It’s not anything they’re assigned to measure, but it’s something that you, as a venture capitalist, have to measure if you’re going to be successful.

ROCK: Correct.

GRUNDFEST: And were there particular aspects of human nature and of character that you thought most important to calculating this intellectual book value?

ROCK: Intellectual honesty.

GRUNDFEST: Talk about that.

ROCK: Would they try to put one over on you to get something done? That’s anti-intellectual value.

GRUNDFEST: I have to ask this. How would you rate Elizabeth Holmes on the scale of intellectual book value?

ROCK: Zero.

GRUNDFEST: Can I suggest a negative number?

ROCK: Well, yeah, for someone like Elizabeth Holmes, yes. The big mistake I made was in the MRI company I helped to start. I helped start the first company that made an MRI machine. And we were pretty successful until it turned out that the person that headed up the company was dishonest.

GRUNDFEST: If you’re a venture capitalist, you’re always at the mercy, as a practical matter, of something going on behind the scenes that you don’t know about.

ROCK: Absolutely. But that’s not as true today. Today, I think, many venture capital firms have enough staff to explore all aspects of management. And I doubt if there are many examples of people doing something as dramatically wrong.

GRUNDFEST: And one of the intriguing aspects of the current venture capital environment, and perhaps closely related to your concept of intellectual book value, is a recent statistic documenting that out of 582 unicorns in the United States—companies valued at more than a billion dollars pre-IPO—55 percent have a founder or co-founder who’s an immigrant.

ROCK: That’s a different story.

GRUNDFEST: It is. But two-thirds are either immigrants or, like you, first-generation children of immigrants. The immigrant population is massively overrepresented among successful pre-IPO companies. Any thoughts on that and how it relates to intellectual book value?

ROCK: I think that this country isn’t hungry anymore.

GRUNDFEST: How does this relate to the over-representation of immigrant energy in successful venture firms?

ROCK: Well, that’s the whole point. These people come over here and they’re hungry. They’re hungrier than our people are.

GRUNDFEST: So, it’s basically the immigrant community that’s generating the innovative energy and also the willingness to take risk.

ROCK: Absolutely. Look at one of the most successful venture capital firms—it’s run by three people. One is a Brit, the second is Italian, and the third is South African.

GRUNDFEST: You’re talking about Sequoia. And then they also have their Chinese arm.

ROCK: Yeah.

GRUNDFEST: So, basically you have four leaders of one of the world’s most successful venture capital firms, and all are immigrants and all bring their own unique form of immigrant energy, having something to prove being here in the United States.

ROCK: I think that’s right.

GRUNDFEST: This question of immigrant energy wouldn’t be alien to you, personally, because you’re first-generation. You’re the son of a Yiddish-speaking Russian immigrant. Does your personal experience fit the notion of immigrant energy?

ROCK: I probably worked harder than the average person.

GRUNDFEST: And how much of that was related to your family’s immigrant status? Was that part of it?

ROCK: Yes. Undoubtedly.

“Intellectual book value is the difference between what the marketplace is on a company and what the actual market is. It can be whatever anyone wants to read into it, but for me it's the value that you put on what people produce that isn't in dollars."

Arthur Rock

GRUNDFEST: In addition to your epic Intel deal, and the industries you helped start, and the trillions in market cap you helped create, many people are unaware of your critical role in the early years of Apple. You had a very close personal relationship with Steve Jobs. Could you tell us a bit about your role in Apple’s early years and your personal relationship with Jobs?

ROCK: You know, I didn’t understand how a computer was made, so my relationship there was just to make sure that these guys, Wozniak and Jobs, were progressing.

GRUNDFEST: So you tried, basically, to keep them organized. And you tried to instill a little bit of corporate culture and structure on the organization.

ROCK: Yeah. That was kind of hard to do. Steve was not about to be organized by anyone.

GRUNDFEST: Or wear shoes.

ROCK: Well, that’s a famous story. We were at a board meeting and Jobs comes in without his shoes. And he puts his feet on the table. Mike Markkula [Apple board chair 1977-1981, CEO 1981-1983, board chair 1985-1997] says, “Steve, you’re excused from this board meeting.” He says, “What?” “Get out of here. Go,” Mike says. “You can come back if you put your shoes on.” So, sure enough, he came back with his shoes on. And he didn’t put his feet up on the desk.

GRUNDFEST: So, he knew how to take a hit.

ROCK: But part of the problem, of course, was controlling Steve. We finally told him we had to get a CEO and we did. And that worked out well for nine years [with John Sculley as CEO]. Then his wife decided that she didn’t like California and insisted that they move to New England. After a year of his flying back and forth, it was evident that things were not going well, and the board asked him [Sculley] to resign.

GRUNDFEST: Apple’s history, in a sense, has three phases. In the first, you and Steve were deeply involved. In the second, Jobs leaves Apple and creates NeXT Computer and Pixar. And then there’s the third, in which Jobs returns to Apple and that begins the current glory years. But let’s put that aside for a moment, because there’s a personal dimension to your relationship with Steve Jobs.

ROCK: Well, we had a very close relationship. I can’t tell you how many dinners he had here, and we used to go out together and he always had a girlfriend, a different one.

GRUNDFEST: I understand you and he were ski buddies.

ROCK: I introduced him to skiing. And he came and stayed at our house in Aspen. We were very close and, unfortunately, he left. Everybody thinks we fired him, but we didn’t. We told him that he couldn’t run the company anymore.

GRUNDFEST: You demoted him in a way that would be, in his view, incompatible with staying.

ROCK: Absolutely.

“You know, I didn’t understand how a computer was made, so my relationship there was just to make sure that these guys, Wozniak and Jobs, were progressing.”

Arthur Rock

GRUNDFEST: One of the other things that I learned reading Mallaby’s book, The Power Law, is that many people want to be like Arthur Rock. So, how do they do that?

ROCK: I don’t know. I had a tough upbringing and maybe that had something to do with it. I didn’t get along with a lot of people.

GRUNDFEST: You learned how to be ornery and stand up for your rights?

ROCK: That’s about it.

GRUNDFEST: One of the other things I remember you telling me when we were having drinks a few years ago is how important it is to be lucky.

ROCK: Everybody has a certain amount of luck. It depends on when you get it. I was lucky enough to get it early.

GRUNDFEST: You know, it’s possible that you’re one of the luckiest people I’ve ever met, but that you’re also one of the smartest and most principled because at each turn you also shared your luck with other people and you created teams who worked together toward a common goal.

ROCK: Yeah.

GRUNDFEST: I mean that’s what you accomplished at Intel. What terrific luck to establish the first huge participant in the huge semiconductor industry. You didn’t take for yourself the maximum you could. You shared it.

ROCK: Well, when I met those seven or eight first employees, they didn’t know what I was talking about. About money.

GRUNDFEST: And you didn’t take advantage of them.

ROCK: No.

GRUNDFEST: If we look at every deal that you’ve ever done, in every case, you helped other people succeed. You never took it all for yourself. You helped others get rich too.

ROCK: Well, I couldn’t have done it alone.

GRUNDFEST: You certainly could have been greedier than you were in every one of those deals.

ROCK: Oh yeah.

GRUNDFEST: Let’s end by shifting gears to a topic that I know is very important to you, and that’s education. You are spending a lot of time these days not on venture capital, but on education.

ROCK: Almost a 100 percent.

GRUNDFEST: Please share with us your views about the current state of education and why that absorbs 100 percent of your energy now.

ROCK: Well, if the people growing up today are not going to be as venture-oriented or do things that lead to a better economy, we’re in trouble. I think that the government is doing an extremely poor job of educating the youth of this country. I don’t mind saying it, I think it’s because of the unions. But charter schools are doing quite well. So, I’m spending most of my time helping develop charter schools and new ways of educating kids.

GRUNDFEST: I understand you’re doing it with a very strong focus on helping minority and lower-income students.

ROCK: Right.

GRUNDFEST: So, your priority is to get these students into schools that will actually educate them. And your view is that charter schools are doing a better job of this.

ROCK: That’s correct.

GRUNDFEST: And many of these are in inner-city communities.

ROCK: Most of them are.

GRUNDFEST: As you look at all of the efforts you’re supporting, is there a strategy that’s helping minority students close that gap?

ROCK: Well, when I started in this business, maybe 15, 20 years ago, the whole object of the philanthropists who were helping was to get the kids into grammar school because many didn’t even get beyond the second or third grade. Now we’ve had some success and they’re through grammar school, so what’s next? Get them into high school. You get them into high school, then what do you do? You get them into college. And that’s what we’re working on now.

GRUNDFEST: So now your main focus is making sure that minority and lower-income students are college ready. You’re helping support some of the most successful programs in the country at achieving that goal.

ROCK: And most of these schools are minority schools.

GRUNDFEST: That’s terrific, and this has been a wonderful opportunity to visit with you.

ROCK: Thank you for coming over, Joe.

GRUNDFEST: It was a pleasure, Arthur. SL